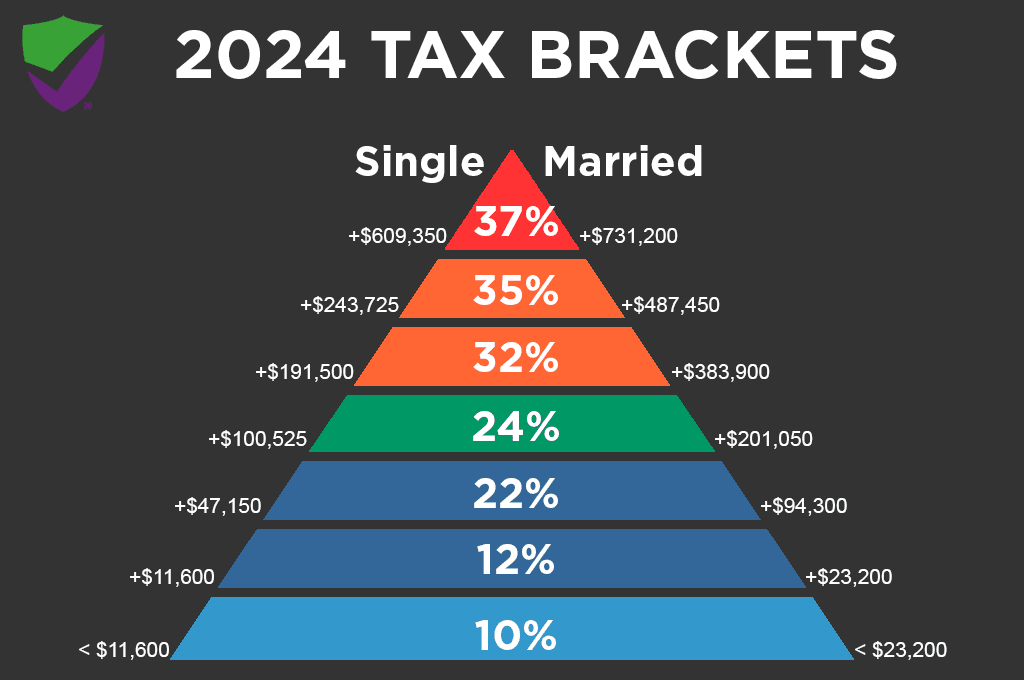

File Your 2025 Taxes for Free ($79k YR and Under – IRS FREE FILE)

Offer Details 👇

🚨 Get Notified 🚨

Want email notifications so you aren't missing out on offers? Well subscribe below, its free and you can unsubscribe at anytime!

Join 2,856 other subscribers

👇 Leave a comment 👇Have something to say about this offer? Let us know in the comments below!

You may also like

Leave a Reply